Mayor Indya Kincannon speaks to Knoxville business leaders about proposed half cent sales tax increase

Brandon Bruce also addressed the room about attracting outside investment, businesses, and talent, and how the proposed Local Option Sales Tax plays into the equation.

Community members in the City of Knoxville may have heard talks of a potential Local Option Sales Tax increase of half a cent.

If passed, it could make $7.63 toilet paper $7.66 at the register— a three-cent increase.

Or for the purchase of a larger ticket item, like a car, it could make the $10,925 turn into $10,933 at the closing table—an $8 increase. The state law has a cap for Local Option Sales Tax, so the tax stops after $1,600. So, the maximum increase of a half cent is $8.

Knoxville Mayor Indya Kincannon has proposed a half-cent increase to the current city sales tax to work on projects like improving parks, city roads, housing, safety projects, and facilities.

On Tuesday morning, she addressed a room full of business and community leaders who gathered at the Knoxville Chamber to learn more about the initiative.

How much sales tax is the city proposing?

Knoxville residents pay a sales tax of 9.25 percent, and about three-fourths of that revenue goes to the State of Tennessee, where the General Assembly decides how to allocate it.

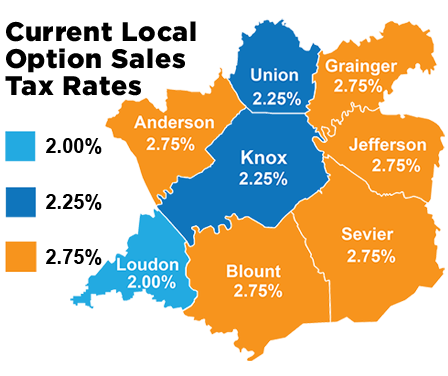

This leaves about a quarter of the revenue as “Local Option Sales Tax” for the City of Knoxville to spend on improving parks, city roads, housing, safety projects, and city facilities. That amount is currently a 2.25 percent sales tax.

Knoxville Mayor Indya Kincannon has proposed increasing the Local Option Sales Tax to 2.75 percent, which would turn the total sales tax into 9.75 percent.

“We are one of the last communities across the state to bring this to voters. As you can see, most of the surrounding counties asked their voters about this proposition and adopted it a long time ago,” she said at the Chamber breakfast.

Meaning, if people already shop at Tanger Outlets in Sevierville or eat at restaurants in Maryville, they are already paying the extra sales tax in those cities.

Why does the city want more sales tax?

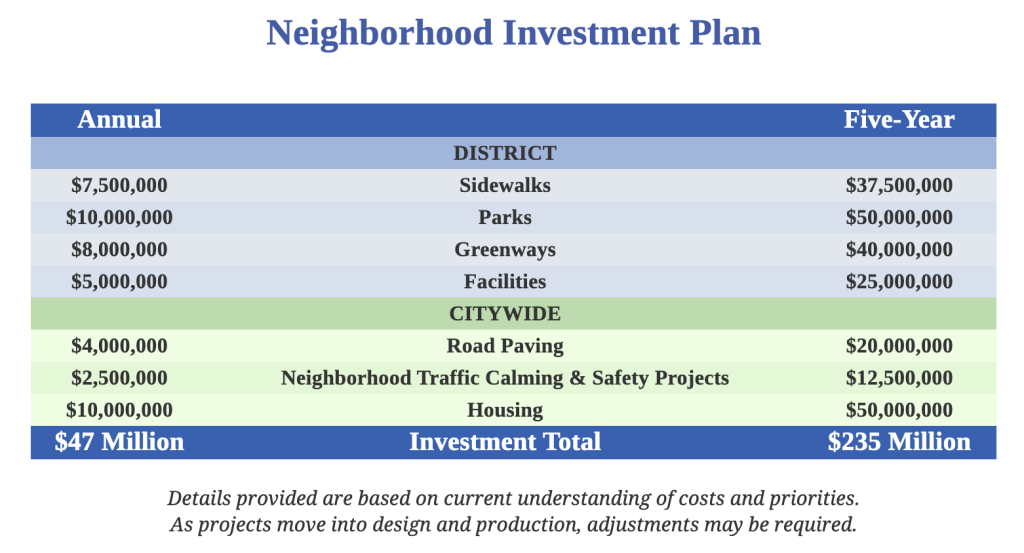

Mayor Indya Kincannon said the focus is on quality-of-life neighborhood investments, and allowing the City to do in five years, which would otherwise take about 25 years.

“We have a sidewalk plan, we have a greenways plan, we have a parks plan, and people are always clamoring for improvements, investments in these things. But, we only go as fast as our money allows,” Kincannon said, explaining that the City is committed to a balanced budget.

For example, she said the half-cent increase would allow the City to pave an additional 15 miles, on top of their current 40 per year on city roads, to avoid new and emerging potholes.

Additionally, the City wants to use the sales tax to help support the design and construction of new, affordable housing.

“There’s no affordable housing aisle in Home Depot. The cost of construction is the same, whether you’re doing very high-end condos or modest, affordable apartments,” she said. “A tool we have is to offer city support for financing these projects. For every $1 the city puts in, the private sector puts in $15. I would say that’s a pretty good return on investment.”

Why does this matter to the innovation and business community?

Brandon Bruce, serial entrepreneur, co-founder of the 121 Tech Hub, as well as General Partner of Market Square Ventures (MSV), attended the Mayor’s breakfast and offered some brief remarks about how it could affect Knoxville’s business attraction and retention power.

He said when MSV looks at deals, they look to see if the founder has invested in themselves, and if they’ve received traction with other VC firms.

For the City, when it comes to attracting outside investment, businesses, and talent, Bruce said the question is: are we willing to invest in ourselves?

He continued to share that people may move to Knoxville for work or school, but they stay because of the parks, greenways, sidewalks, and safe neighborhoods.

What is not included? And who pays?

If the Local Option Sales Tax increase went into effect, nobody living and buying in Knoxville would be exempt from it. The half-cent increase would be the same for a multi-million dollar business owner as it would be for a single mom.

It would also be paid by any tourist, regional visitor, or surrounding county resident who happens to shop in a Knoxville-based store. For example, nearly 70 percent of the people who shop in Turkey Creek, which is in the city limits, are from surrounding counties.

But some line items are immune to the proposed tax: rent, gas, groceries (food & ingredients – excluding alcohol), healthcare visits, utilities, bus fare, prescriptions, and property taxes.

Meaning consumers would see a half-cent tax increase for items like deodorant, diapers, cars, hotel stays, movie tickets, and eating at a restaurant downtown.

What’s the status of the proposal?

The sales tax increase proposal will be on the November 4th ballot. Until then, Kincannon said a team of people is door-knocking and chatting with city residents about the proposed use of the increased Local Option Sales Tax revenue.

Right now on the City’s website, you can see a list of projects under the “Neighborhood Investment Plan,” and how much each one is slated to cost.

Some elected officials, like Councilmember Andrew Roberto, said in his September 17th blog that he would vote against the sales tax increase, pointing toward a lack of clarity about which roads will be paved and where new housing units will go.

He said in his blog post: “There is no binding assurance that future leaders will follow these priorities.”

At this time, the only other councilmember who has publicly opposed the Mayor’s proposed sales tax increase was Amelia Parker, who was also the sole councilmember to vote against putting it on the November 4th ballot.

She said, “The tax increase is regressive, meaning it would have a higher impact per purchase the less money a person makes.”

The rest of the councilmembers voted to leave it up to Knoxville voters.

Mayor Kincannon told Chamber breakfast attendees that she remains confident.

“I’d like to think this is going to pass. I’m out there knocking on doors, explaining the situation to people. I think we do have a really good shot at winning this,” Kincannon concluded.

If passed, the Local Option Sales Tax increase of 0.5% would go into effect on March 1, 2026.

[Note – A special thank you to Raven Edwards at the Knoxville Chamber for the photos in today’s article.]

Like what you've read?

Forward to a friend!