Time to file those taxes!

The tax deadline is Monday, April 15.

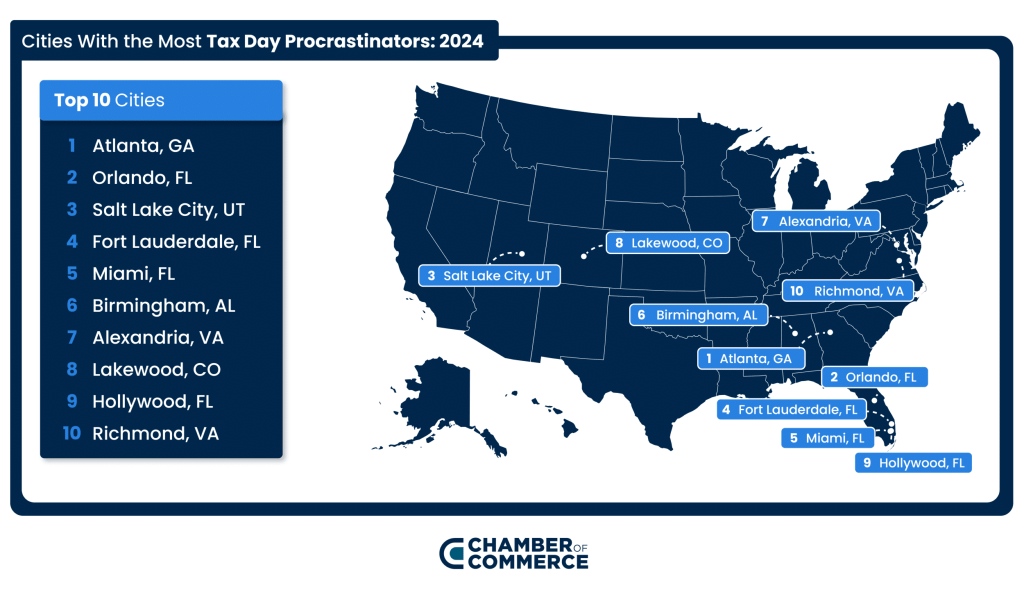

A study released by ChamberOfCommerce.org, shows that Knoxville is one of the 15 worst cities when it comes to meeting tax return deadlines. Some may characterize our region as procrastinators, due to this fact; however, I believe it is a compliment to East Tennesseeans. We enjoy living in the moment!

According to the report, 42 percent of Americans say they’d rather endure a dentist appointment than file their taxes, and about 31 percent say they would rather wait in rush hour traffic.

Therefore, about 30 percent of Americans wait until the last minute to file.

Thankfully, Knoxville doesn’t “take the cake” regarding tax procrastination. Atlanta, Orlando, and Salt Lake City were listed as the top three states with the most tax-filing procrastinators. Florida had four cities listed in the top 10. Southern cities stuck out like a sore thumb on the list.

Unsurprisingly, the bulk of procrastinators come from Generation Z. 35 percent of Gen Z is predicted to procrastinate, followed by 29 percent of Millennials. And in addition to doing them last minute, about 60 percent of Gen Z is also expected to rush through the return.

Is all the commotion, procrastination, and attention to detail worth it?

According to the Internal Revenue Service (IRS), the average refund in 2023 was $2,753, while the average in 2022 was $3,012.

So for some people, yes, it is. For those expecting a tax refund this year, Americans expect to receive roughly $2,009.

View the Chamber’s report here.

Like what you've read?

Forward to a friend!