Launch Tennessee releases Q4 “TN Deal Report”

With $276 million raised, data showed 23.9 percent quarter-over-quarter and 51.7 percent year-over-year growth rates, respectively.

As the first month of 2024 drew to a close on Wednesday, Launch Tennessee released its Q4 “TN Deal Report” that offered some interesting insights into trends across the Volunteer State.

Compiled by Evan Prislovsky, Capital Associate, the report noted that “Tennessee’s investment landscape showed resilience this quarter, with total funding reaching $276 million (excluding Main Street Health’s $315-million raise as an outlier). This represents a hearty 23.9 percent QoQ (quarter-over-quarter) and 51.7 percent YoY (year-over-year) growth rate, respectively.”

Notable deals cited by Launch Tennessee included four from East Tennessee:

- Personality Pool (Kingsport), the inaugural recipient of a total of $300,000 – $150,000 each from “InvestTN” and local investors – for its video interviewing and artificial intelligence (AI) -powered personality screening software to improve hiring for customer-facing roles.

- Allera (Chattanooga) – $750,000 pre-seed funding for a food tech platform providing quality assurance and operations documentation plus AI data analytics.

- Aro (Knoxville) – $1.1 million in seed funding to help reduce phone screen time through gamification.

- Prosal (Chattanooga) – $1.1 million seed funding for a request for proposal marketplace connecting companies with agencies/vendors for projects.

Among other trends that Launch Tennessee noted were:

- Deal volume dropped further by about 19 percent QoQ.

- Larger Series A & B and growth deals drove funding increases, especially in health tech and fintech, mirroring broader Southeast trends.

- Tennessee ranked 24th among U.S. states in total 2022 venture funding after holding the 25th spot in 2021. It now ranks 16th in funding YoY for 2023, behind Georgia, North Carolina, Virginia, and Florida.

- Chattanooga is seeing more pre-seed and seed deals as Brickyard Fund I brings teams to the area.

- Health Tech firms accounted for more than 21 percent of Tennessee’s deals and brought in 73 percent of funding, highlighting vigorous investor appetite for early to growth stage businesses in this space.

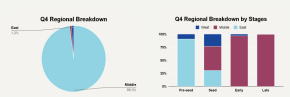

While East Tennessee did very well in pre-seed and held its own with the other two geographic regions of the state on seed stage investments, the vast majority of the early and late stage investments went to firms in Middle Tennessee (see graphic). Only 2.0 percent of the total dollars raised by start-ups occurred outside on the midstate.

While East Tennessee did very well in pre-seed and held its own with the other two geographic regions of the state on seed stage investments, the vast majority of the early and late stage investments went to firms in Middle Tennessee (see graphic). Only 2.0 percent of the total dollars raised by start-ups occurred outside on the midstate.

The organization offered a set of outlooks for 2024:

- Bridge funding rounds are expected to remain popular as overall venture capital activity declines. This allows existing investors to support their top start-ups at more favorable valuations during a period of market uncertainty.

- Start-up failures have hit record highs while funding availability has tightened significantly. This will likely intensify competition among start-ups for limited venture dollars in 2024. It also creates potential opportunities for investors to find deals at lower valuations.

- There is expected to be an increase in pre-seed and seed deals across Tennessee with the launch of “InvestTN” fund in Q4 of 2023.

Like what you've read?

Forward to a friend!